Interest Rate Swaps: A Financial Tool for Borrowers

This presentation introduces interest rate swaps as a tool for managing interest rate risk. It explains the functionality and purpose of swaps, and discusses why borrowers should consider using them. The presentation also explores other types of protection, historical and expected rates, and concludes with a Q&A session.

- Uploaded on | 0 Views

-

jovie

jovie

About Interest Rate Swaps: A Financial Tool for Borrowers

PowerPoint presentation about 'Interest Rate Swaps: A Financial Tool for Borrowers'. This presentation describes the topic on This presentation introduces interest rate swaps as a tool for managing interest rate risk. It explains the functionality and purpose of swaps, and discusses why borrowers should consider using them. The presentation also explores other types of protection, historical and expected rates, and concludes with a Q&A session.. The key topics included in this slideshow are interest rate swaps, financial tool, managing risk, borrower, functionality, purpose,. Download this presentation absolutely free.

Presentation Transcript

1. Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. 2012 WINDY CITY SUMMIT INTEREST RATE SWAPS PRESENTATION

2. 2 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. Table of Contents Derivatives Overview Derivatives and Interest Rate Risk The Interest Rate Swap What is it? Purpose and Functionality Swaps and Me Why should todays borrower consider it? Other Types of Protection Caps and Collars Wheres the Crystal Ball? Historical and expected rates Q & A INTEREST RATE SWAPS

3. DERIVATIVES OVERVIEW

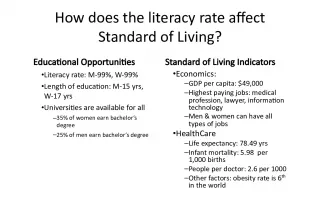

4. 4 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. DerivativesWhat are They? Derivatives are financial instruments whose value is derived from another "underlying" financial security. An interest rate derivative gains or loses value based on the movements of a specific interest rate index (U.S. Dollar Prime, LIBOR, Fed Funds, Treasury yields, etc.). There are two broad categories of derivative products: Exchange-traded products Often used by traders & speculators (and dealers looking to balance their books) Standardized contract sizes & terms Not typically used for customized hedging solutions Over-the-counter (OTC) products Developed to meet hedging demand by companies & investors Customized contracts between 2 counterparties INTEREST RATE SWAPS

5. 5 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS DerivativesGrowth in the OTC Market Source: BIS

6. 6 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS DerivativesWhy? One wordRISK! Source: Chatham Financial Decrease of $ 12.1mm in interest cost in four months (148bps * $82k) Increase of $ 10.4mm in interest cost in six weeks (127bps * $82k) 10-Year UST Example of interest rate exposure on a $100 million, 10-year financing. The present value of every basis point change in interest rates prior to locking the rate is worth about $82,000!

7. 7 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. Term Structure of Interest Rates: When you hear interest rates moved lower today which rates are being discussed?? Short-term deposit rates? Intermediate maturity rates? Long-term mortgage rates? Interest rates differ across the maturity spectrum due to: Liquidity Market expectations Concept known as the Yield Curve INTEREST RATE SWAPS Interest Rate Markets

8. 8 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS Source: Wintrust Financial

9. THE INTEREST RATE SWAP

10. 10 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. What is an OTC Interest Rate Swap? An agreement between two parties in which one party agrees to pay a fixed rate of interest and the other agrees to pay a floating rate of interest on an agreed upon notional amount No principal changes hands, simply an exchange (swap) of interest payments for a set period of time Swap rate is derived from market expectations The FIXED rate is the Present Value of Expected Future FLOATING rates LIBOR is the foundation of the swap market INTEREST RATE SWAPS Party A Party B LIBOR Fixed Rate

11. 11 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. How Does an Interest Rate Swap Work? Overview: Interest rate swaps allow borrowers to effectively lock-in an interest rate on an existing or future variable rate financing Method: Separate contract from the loan that effectively fixes the rate by creating a stream of cash flows that perfectly offsets any rise in rates Cost: There are no incremental fees associated with the interest rate swap INTEREST RATE SWAPS Borrower Borrower Bank Bank Loan Floating Rate Floating Rate Fixed Rate

12. 12 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. How does the market demand what the proper fixed rate is for an interest rate swap? A swap is simply an exchange of cash flows: therefore, the party paying a fixed rate should demand a rate that is, on a present value basis, the average of the markets expected floating rate settings over the term of a particular swap contract. One mechanism for predicting the future path of rates is by observing the interest rate futures market. In general, 3-month LIBOR serves as a baseline rate for calculating an interest rate swaps fixed rate. INTEREST RATE SWAPS How are Swap Rates Determined?

13. 13 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. London Inter-Bank Offered Rate: Rate at which banks lend to one another for various terms Resets each day at 11:00 a.m. (London time) based on average of 16 contributor banks 3-Month LIBOR = Fed Funds + 0.25%* (historical avg.) Prime = 3-Month LIBOR + 2.75%* (historical avg.) Any variations in OTC structures (1-month LIBOR, Prime, etc.) are taken into account by calculating a specific spread, or basis, to the 3-month LIBOR futures market INTEREST RATE SWAPS LIBOR is the Foundation of the Swap Market

14. 14 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS Fixed rates are derived from the present value average of the markets expectation of future floating rates over a given term If the markets prediction of rates is CORRECT , there is no difference between paying fixed or paying floating on the same notional If the markets prediction of rates is NOT CORRECT , the swap will gain or lose value How is the Fixed Swap Rate Determined?

15. 15 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. Valuation of an Interest Rate Swap At inception, the swap has no value because the swap rate represents the average of what the market believes variable rates will be over the life of the swap As rates change, the swap will begin to take on or lose value If the swap holder needs to break the contract before maturity, it may be subject to breakage provisions: Rates Rise: Replacement Swap Rate > Actual Swap Rate, swap is an asset to the swap holder. The swap holder will receive payment from the Counterparty for the value of the swap. Rates Fall: Replacement Swap Rate < Actual Swap Rate, swap is a liability to swap holder. The swap holder will make a payment to the Counterparty for the value of the swap. INTEREST RATE SWAPS

16. SWAPS AND ME

17. 17 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. What are the Benefits of an Interest Rate Swap? Flexibility: All or a portion of the term All or a portion of the notional Duration: Longer term financing available Certainty: Known debt service costs Bi-lateral Prepayment: Retain benefit if rates rise Prepayment often less than traditional yield maintenance if rates fall Core-Competency: Swaps allow borrowers to focus on their line of business and not fluctuations in the interest rate markets Current Rate Environment: Swaps allow borrowers to take advantage of below-market rates when compared to traditional fixed loan rates INTEREST RATE SWAPS

18. 18 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. What Types of Debt can be Hedged? Over-the-counter Interest Rate hedging products are customized contracts Provide great flexibility to borrower Loan amortization characteristics can be matched in a derivative hedge contract: Construction loans Forward Starting Irregular/ uncertain draw schedule Permanent financing Monthly, quarterly, or semi-annual payments Mortgage, Hybrid, Straight-line, I/O, Custom amortization INTEREST RATE SWAPS

19. OTHER TYPES OF PROTECTION

20. 20 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. Other Types of Hedging Products An interest rate CAP will: Guarantee the borrower a maximum fixed rate, yet allow the borrower to retain the properties of a floating rate loan under a specific strike rate Cost the borrower a premium to purchase, paid upfront Be most cost-effective for terms under 5 years and/or when providing worst case disaster protection at a high cap strike rate An interest rate COLLAR will: Guarantee the borrower a maximum fixed rate, yet also require the borrower to pay a certain minimum rate (even if market rates fall below this pre-determined floor strike rate) Help or fully offset the cost of a cap by borrower selling a floor to Bank INTEREST RATE SWAPS

21. 21 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. What is an Interest Rate Cap? Example of a $5MM Cap struck at 1.25% INTEREST RATE SWAPS

22. WHERES THE CRYSTAL BALL?

23. 23 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS Source: WSJ Historical Average (since 1989) = 3.9219%

24. 24 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS Source: Wintrust Financial

25. 25 Copyright 2012 Wintrust Financial Corporation. All Rights Reserved. INTEREST RATE SWAPS Source: FRB Historical Average (since 2000) = 3.8737%

26. QUESTIONS?