Accounting Jeopardy Century 21 Accounting Chapter 6 by Mrs. Saylor

This Accounting Jeopardy game is focused on Chapter 6 of Century 21 Accounting and is hosted by Mrs. Saylor. The categories include

- Uploaded on | 1 Views

-

nellie

nellie

About Accounting Jeopardy Century 21 Accounting Chapter 6 by Mrs. Saylor

PowerPoint presentation about 'Accounting Jeopardy Century 21 Accounting Chapter 6 by Mrs. Saylor'. This presentation describes the topic on This Accounting Jeopardy game is focused on Chapter 6 of Century 21 Accounting and is hosted by Mrs. Saylor. The categories include. The key topics included in this slideshow are . Download this presentation absolutely free.

Presentation Transcript

Slide1Accounting Jeopardy Century 21 Accounting Chapter 6 by Mrs. Saylor Accounting Jeopardy Century 21 Accounting Chapter 6 by Mrs. Saylor

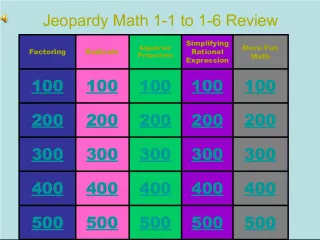

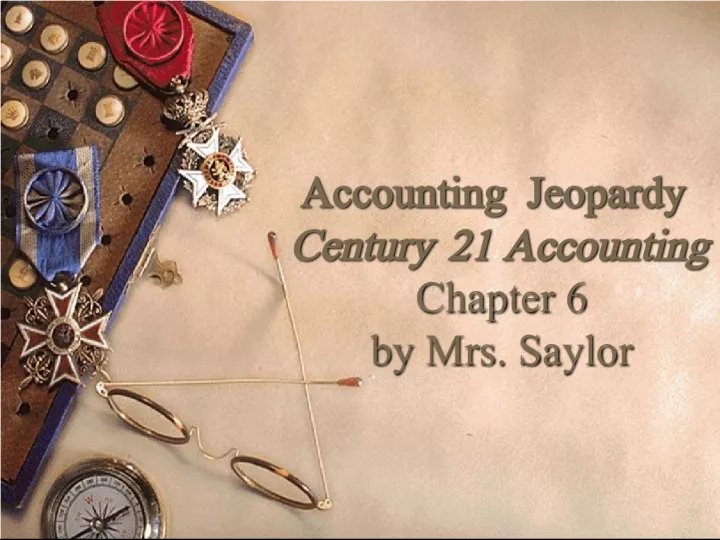

Slide2Accounting JeopardyAccounting Concepts General & Adjustments Work Sheet Correcting Errors 100 100 100 100 200 200 200 200 300 300 300 300 400 400 400 400 500 500 500 500

Slide3CreditsCentury 21 Accounting That’s all folks. Exit

Slide4Accounting Concepts $100 Making adjustments to general ledger accounts is an application of the Matching Expenses with Revenue accounting concept.

Slide5Accounting Concepts $100What is True?

Slide6Accounting Concepts $200 The accounting concept Consistent Reporting is being applied when a word processing service business reports revenue per page one year and revenue per hour the next year.

Slide7Accounting Concepts $200 What is False? The reporting needs to be the same for every year. Use revenue per page every year.

Slide8Accounting Concepts $300 Following the same accounting procedures in the same way in each accounting period is an application of the accounting concept _____ _____.

Slide9Accounting Concepts $300What is Consistent Reporting ?

Slide10Accounting Concepts $400 Reporting changes in financial information for a specific period of time in the form of financial statements is an application of the accounting concept _____ _____ _____.

Slide11Accounting Concepts $400 What is Accounting Period Cycle ?

Slide12Accounting Concepts $500 Recording Revenue from business activities and expenses associated with earning that revenue in the same accounting period is an application of the accounting concept _____ _____ _____ _____.

Slide13Accounting Concepts $500What is Matching Expenses With Revenue?

Slide14General & Adjustments $100 Many businesses choose a one-year fiscal period that ends during a period of high business activity.

Slide15General & Adjustments $100 What is False? Choose a fiscal period that ends during a period of LOW business activity.

Slide16General & Adjustments $200 The balance of the supplies account plus the value of the supplies on hand equals the up-to-date balance of the supplies account.

Slide17General & Adjustments $200 What is False ? The balance of the supplies account less the value of the supplies used up equals the up-to-date balance of the supplies account.

Slide18General & Adjustments $300 The value of the prepaid insurance coverage used during a fiscal period is an expense.

Slide19General & Adjustments $300 What is True ? The account is Insurance Expense.

Slide20General & Adjustments $400 Financial information may be reported any time a business needs it.

Slide21General & Adjustments $400 What is True ?

Slide22General & Adjustments $500 The two accounts affected by the adjustment for insurance are Prepaid Insurance Expense and Insurance.

Slide23General & Adjustments $500 What is False ? The two accounts affected by the adjustment for insurance are Prepaid Insurance and Insurance Expense .

Slide24Work Sheets $100 When the Income Statement Credit column total is greater than the Income Statement Debit column total on a work sheet, the business has a net income.

Slide25Work Sheets $100 What is True ?

Slide26Work Sheets $200 If an amount is written in an incorrect column on a work sheet, the error should be erased and the amount should be written in the correct column.

Slide27Work Sheets $200 What is True ?

Slide28Work Sheets $300 On a work sheet, the balance of the owner’s capital account is extended to the _____ _____ _____ column.

Slide29Work Sheets $300 What is Balance Sheet Credit ?

Slide30Work Sheets $400 A net loss is entered in the work sheet’s _____ _____ Credit and _____ _____ Debit columns.

Slide31Work Sheets $400 What is Income Statement Credit & Balance Sheet Debit

Slide32Work Sheets $500 On a work sheet, the balance of an expense account is extended to the _____ _____ _____ column.

Slide33Work Sheets $500 What is Income Statement Debit ?

Slide34Correcting Errors $100 If the Trial Balance columns are not equal and the difference is $50.00, the error most likely is a $25.00 amount written in the wrong column.

Slide35Correcting Errors $100 What is True ?

Slide36Correcting Errors $200 If the Trial Balance columns are not equal and the difference is 1, the error most often is in _____.

Slide37Correcting Errors $200 What is Addition ?

Slide38Correcting Errors $300 If the difference between the totals of Debit and Credit columns on a work sheet can be evenly divided by 9, then the error is most likely in addition.

Slide39Correcting Errors $300 What is False ? The error is a number transposed ($54.00 instead of $45.00) or a number slide ($100 instead of $1,000).

Slide40Correcting Errors $400 If there are errors in the work sheet’s Trial Balance columns, it might be because not all general ledger account balances were copied in the Trial Balance columns correctly.

Slide41Correcting Errors $400 What is True ?

Slide42Correcting Errors $500 If a pair of work sheet columns do not balance and the difference between the totals is an amount that appears elsewhere on the work sheet, the error is probably an amount that has not been _____.

Slide43Correcting Errors $500 What is Extended ?