Oil Sector Financing through Securitization

Learn about the goals and constraints of securitization, and how it can provide long-term financing for the oil sector. Discover oil securitization deals in Africa and experiences from around the world at the Africa Oil & Gas Trade and Finance Conference.

- Uploaded on | 1 Views

-

benjamin1

benjamin1

About Oil Sector Financing through Securitization

PowerPoint presentation about 'Oil Sector Financing through Securitization'. This presentation describes the topic on Learn about the goals and constraints of securitization, and how it can provide long-term financing for the oil sector. Discover oil securitization deals in Africa and experiences from around the world at the Africa Oil & Gas Trade and Finance Conference.. The key topics included in this slideshow are . Download this presentation absolutely free.

Presentation Transcript

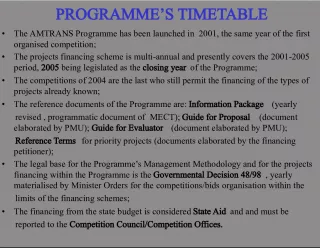

Slide1Orrick PowerPointTemplate January 17, 2001 Name of Presenter Securitization and Oil Sector Financing Pascal K. Agboyibor Orrick, Herrington & Sutcliffe - Paris April 29, 2004 Marrakech, Morocco 8 th Africa Oil & Gas Trade and Finance Conference NOT AN OFFICIAL UNCTAD RECORD

Slide22Agenda Introduction Goals of Securitization Constraints of Securitization A Receivables Securitization for Long Term Oil Financing Oil Securitization deals in Africa Oil Securitization experience in the world

Slide33Introduction Traditional Structured Finance Techniques Export Receivables Prepayment Export Receivables Backed Lending Implementation of Basle II will lead to other techniques including securitization

Slide44Export Receivables Prepayment Local Oil Company Buyers SPV/Trader Sale of Crude Oil (3) Bank prepayment (2) receivables (5) Loan (1) Export of Crude Oil (4)

Slide55Export Receivables Prepayment (legends) 1) The Bank will grant a loan to the SPV/Trader 2) Under a Prepayment Agreement the SPV /Trader will use the Loan to make payment to the Local Oil Company 3) Pursuant to the Prepayment Agreement and the forward sales contract, the Oil Company will sell the Crude oil to the SPV /Trader 4) Under Export Sales Agreements of Crude Oil the SPV /Trader will sell the Crude Oil to the Buyers 5) The SPV /Trader will transfer to the Bank the receivables generated or to be generated by the export of Crude Oil

Slide66Export Receivables Prepayment Local Oil Company Buyers Sale of Crude Oil (2) Bank Exports receivables (3) Loan (1)

Slide77Export Receivables Prepayment (legends) 1) The Bank will make a Loan to the Local Oil Company 2) Under Export Sales Agreements the Local Oil Company will export crude oil to the Buyers 3) The Local Oil Company will transfer to the Bank the export receivables generated or to be generated by the sale of Crude Oil

Slide88Goals of Securitization Reduce credit and/or prepayment risk Source of relatively low-cost financing and/or liquidity Diversification of investor base Longer-term, revolving finance becomes possible Obtain off-balance sheet financing

Slide99Constraints of Securitization Due to high level fixed costs (investment bank structuring fees, rating agencies fees) volume is required. Transaction amounts are often over USD 100 million Legal constraints (true sale recognition, bankruptcy issues, opposability against buyers creditors…) Operational and financial reporting

Slide1010A Receivables Securitization for Long Term Oil Financing Securitization enables longer-term and revolving finance for commodity trade and production projects. It relies on future export flows of oil The following chart and related footnotes outline flows of funds among the principal parties under the securitization transaction

Slide1111A Receivables Securitization for Long Term Oil Financing XXX Buyers XXX Islands III Corp. (the « Issuer ») Investors XXX Export Co. Prepayments (5) Crude Oil (6) Payments for Crude Oil sold by XXX Export Co. (8) Payments of principal of and interest on the Notes (9) Payments under the Originator Note (10) Notes (1) Proceeds of Notes (2) Receivables (4) Purchase Price of Receivables (3) Crude Oil (7) Collection Account

Slide1212A Receivables Securitization for Long Term Oil Financing (Legends) 1) The Issuer will issue one or more Series of Notes to investors 2) Net proceeds from the sale of the Notes are paid to the Issuer 3),4) The proceeds of the issuance of the Notes will be paid to XXX Export Co. in consideration of the purchase of rights to certain receivables generated or to be generated by the sale of Crude Oil by XXX Export Co 5) Under a Prepayment Agreement, XXX Export Co. will use the net proceeds received from the Issuer, together with other funds on hand, to make a prepayment to XXX in consideration of XXX’s obligations under the Prepayment Agreement 6) Pursuant to the Prepayment Agreement and the Master Export Contract, XXX will agree to sell to XXX Export Co. the required quantities of Crude Oil 7) XXX Export Co. will sell Crude Oil to the Buyers 8) Each of the Buyers will be instructed, and certain Buyers will agree in Notice and Consents, to make payment for Crude Oil to the Collection Account 9),10)Proceeds in the Collection Account will be used to pay, among other things, principal, interest and other amounts scheduled or otherwise required to be paid in respect of the Notes, fees owed to the Trustee and the Servicer, and amounts due in respect of the Originator Note

Slide1313Securitization Potential by Region Securitization potential by region (based on 1998 data on exports and remittances) (billion dollars) Fuels Minerals Remittances Total East Asia Europe and Central Asia Latin America and Caribbean Middle East and North Africa South Asia Sub-Saharan Africa Total for low- and middle-income countries 5.3 9.8 7.5 16.5 0.1 ... 39.2 2.1 4.6 5.2 0.4 0.2 ... 12.6 0.1 0.7 1.3 1.0 1.4 0.2 4.8 7.5 15.1 14.0 17.9 1.7 0.2 56.4 Source: Authors' calculations using overcollateralization ratio of 5:1. Data on exports are from the World Bank's World Development Indicators, data on worker remittances from the IMF's Balance of Payments Statistics Yearbook (1999). Note: ... denotes data not available. Regions are as defined in the World Bank's annual publication Global Development Finance .

Slide1414Oil Securitization deals in Africa The Mobil Producing Nigeria securitization (1996) Mobil Producing Nigeria raised US$ 330 million on the US capital market Interest rate paid on this 7-8 year loan was 4 per cent lower than what Mobil otherwise could have expected to pay

Slide1515Oil Securitization Experience in the world Pemex Finance Ltd. Oil Securitization in 1998 (Mexico) Securitization of receivables generated from petroleum products sales raising $390 million YPF Oil Securitization (Argentina) Securitization of future export receivables raising $400 million Petroleum Company of Trinidad and Tobago (Petrotrin) Securitization of receivables generated through a 12 year forward sale of refined product raising $150 million Kazakhstan Halyk Bank raising $100 million

Slide1616Contact Info Pascal Agboyibor Orrick 47, Rue de Monceau 75008 Paris ()33-1-5353-7500 pagboyibor@orrick.com