Understanding Financial Statements: Importance and Topics

Learn about the importance of financial statements in understanding a business' financial position, policies, and future performance. Topics include balance sheet, income statement, statement of cash flows, and corporate taxes, among others.

- Uploaded on | 7 Views

-

brucebaker

brucebaker

About Understanding Financial Statements: Importance and Topics

PowerPoint presentation about 'Understanding Financial Statements: Importance and Topics'. This presentation describes the topic on Learn about the importance of financial statements in understanding a business' financial position, policies, and future performance. Topics include balance sheet, income statement, statement of cash flows, and corporate taxes, among others.. The key topics included in this slideshow are . Download this presentation absolutely free.

Presentation Transcript

1. 1 Chapter 2 Financial Statements, Cash Flow, and Taxes

2. 2 Topics in Chapter Balance sheet Income statement Statement of cash flows Free cash flow MVA and EVA Corporate taxes

3. Importance of Financial Statements Form the basis for understanding the financial position of a business Provide information regarding the financial policies and strategies and insight into future performance 10-K and 10-Q 3

4. Balance Sheet 4

5. 5 Balance Sheet: Assets 2009 2010 Cash $ 9,000 $ 7,282 S-T invest. 48,600 20,000 AR 351,200 632,160 Inventories 715,200 1,287,360 Total CA 1,124,000 1,946,802 Gross FA 491,000 1,202,950 Less: Depr. 146,200 263,160 Net FA 344,800 939,790 Total assets $1,468,800 $2,886,592

6. 6 Balance Sheet: Liabilities & Equity 2009 2010 Accts. payable $ 145,600 $ 324,000 Notes payable 200,000 720,000 Accruals 136,000 284,960 Total CL 481,600 1,328,960 Long-term debt 323,432 1,000,000 Common stock 460,000 460,000 Ret. earnings 203,768 97,632 Total equity 663,768 557,632 Total L&E $1,468,800 $2,886,592

7. 7 Changes on liabilities & equity CL increased as creditors and suppliers financed part of the expansion. Long-term debt increased to help finance the expansion. The company didnt issue any stock. Retained earnings fell, due to the years negative net income and dividend payment.

8. Dells Balance Sheet http://finance.yahoo.com/q/bs?s=DELL +Balance+Sheet&ann 8

9. Balance Sheet highlights Net plant and equipment= gross plant and equipment accumulated depreciation Common stock at par and additional paid-in (capital surplus) Retained earnings Annual addition to retained earnings = net income dividends paid Net worth common equity 9

10. Income Statement 10 Net Sales Less Cost of Goods Sold (COGS) Less Operating expenses EBITDA Less Depreciation Less Amortizations EBIT Less Interest EBT Less Taxes Net income

11. 11 Income Statement Example 2009 2010 Sales $3,432,000 $5,834,400 COGS 2,864,000 4,980,000 Other expenses 340,000 720,000 Deprec. 18,900 116,960 Tot. op. costs 3,222,900 5,816,960 EBIT 209,100 17,440 Int. expense 62,500 176,000 EBT 146,600 (158,560) Taxes (40%) 58,640 (63,424) Net income $ 87,960 ($ 95,136)

12. Dells Income Statement http://finance.yahoo.com/q/is?s=DELL+ Income+Statement&annual 12

13. MicroDrive Income Statement Table 2-2 MicroDrive Income Statements for Years Ending December 31 (in millions of dollars) 2010 2009 INCOME STATEMENT Net sales $3,000.0 $2,850.0 Operating costs except depreciation $2,616.2 $2,497.0 Earnings before interest, taxes, deprn., and amortization (EBITDA)* $383.8 $353.0 Depreciation $100.0 $90.0 Amortization $0.0 $0.0 Depreciation and amortization $100.0 $90.0 Earnings before interest and taxes (EBIT) $283.8 $263.0 Less interest $88.0 $60.0 Earnings before taxes (EBT) $195.8 $203.0 Taxes $78.3 $81.2 Net Income before preferred dividends $117.5 $121.8 Preferred dividends $4.0 $4.0 Net Income available to common stockholders $113.5 $117.8 Common dividends $57.5 $53.0 Addition to retained earnings $56.0 $64.8 *MicroDrive has no amortization charges. 13

14. Income Statement Highlight Operating expenses Include management salaries, advertising expenditures, repairs & maintenance, R&D, general & administrative expenses, lease payments, etc. Earnings per common share (EPS) Companies that issued convertible securities (such as bonds convertible into common stock) and stock options, must calculate two types of earnings per share: basic and diluted. 14

15. 15 Statement of Cash Flows Provides information about cash inflows and outflows during an accounting period Focuses on CASH. Has THREE sections: Cash flow from Operating Activities (OCF) Cash flow from Investing Activities (ICF) Cash flow from Financing Activities (FCF )

16. 16 Compute the changes in some accounts over two periods Which account item goes to Which section ? Accounts receivables Notes payable Depreciation Fixed assets Accruals etc Operating Investing Financing

17. 17 Useful Tip 1 No matter which section you are doing (operating, investing or financing), IF the change of an account leads to a cash INFLOW, you add that change (+); IF the change leads to a cash OUTFLOW, you subtract that change (-) inflow : decreases in assets or increases in liabilities or equity. outflow : increases in assets or decreases in liabilities or equity.

18. 18 Useful Tip 2 Cash flow from Operating Activities + Cash flow from Investing Activities + Cash flow from Financing Activities = CHANGE in cash account

19. Cash flows from operating activities 1 Net income + depreciation +/- change in A/R +/- change in Inv. +/- change in A/P +/- change in Accruals 19

20. 20 Cash flows from operating activities 2 Asset Liability Decreases Add + (cash inflow) Subtract - (cash outflow) Increases Subtract - (cash outflow) Add + (cash inflow)

21. 21 Cash flows from investing activities 1 Investing activities: Buying or selling productive assets (plant & equipment) Buying or selling financial securities (e.g., stocks and bonds of other companies,)

22. 22 Cash flows from investing activities 2 Inflows: Means: Decrease in gross fixed assets Firm sells long-lived assets such as gross property, plant and equipment Decrease in long-term investments Firm sells debt or equity securities of other firms Outflows: Increase in gross fixed assets Firm buys long-lived assets such as gross property, plant and equipment Increase in long-term investments Firm buys debt or equity securities of other firms

23. 23 Cash flows from investing activities 3 Warning : we want changes in GROSS fixed assets. We dont want the changes in net fixed assets! BUT, if gross fixed assets are not reported in balance sheet

24. 24 Cash flows from investing activities 4 change in gross fixed assets = change in net fixed assets + depreciation

25. 25 Cash flows from financing activities 1 +/- changes in N/P +/- changes in current long-term debt +/- changes in long-term debt +/- changes in common and preferred stock +/- changes in capital surplus - Payment of dividends

26. 26 Cash flows from financing activities 2 Inflows: Means: increase in notes payable increase in long-term debt Firm borrows money increase in common stock Firm sells equity securities Outflows: decrease in notes payable decrease in long-term debt Firm repays debt decrease in common stock Firm buys back shares Payment of dividends Firm pays cash to shareholders

27. 27 Cash Flows Workshop Solve Assignment 3.1

28. Dells Statement of Cash Flow http://finance.yahoo.com/q/cf?s=DELL +Cash+Flow&annual 28

29. 29 Analyzing Statement of Cash Flows 1 Statement of CF can help you analyze a company: 1) Relationship between net income and net cash flow from operations (OCF) If net income positive, but OCF is negative, could mean: Company is growing rapidly Financial mis-management

30. 30 Analyzing Statement of Cash Flows 2 2) Net cash flow from investing activities (ICF) If negative, company is making investments Buying plant & equipment (improve efficiencies) Buying another companys stock (strategic reasons, e.g., joint venture) If positive, company is liquidating assets. Why? Financial distress?

31. 31 Analyzing Statement of Cash Flows 3 3) Does company have sufficient cash to pay dividends? OCF should exceed dividends. If dividends exceed OCF, why? Company liquidated assets to pay dividends? Company issued equity or borrow to pay dividends? Neither situation is good.

32. 32 Analyzing Statement of Cash Flows 4 4) Changes in debt Look at cash flow from financing activities substantial increases in debt (either short-term or long-term) Substituting short-term debt for long- term debt may indicate worsening financial health.

33. 33 What is free cash flow (FCF)? Why is it important? FCF is the amount of cash available from operations for distribution to all investors (including stockholders and debtholders) after making the necessary investments to support operations. A companys value depends on the future FCF it can generate.

34. 34 What are the five uses of FCF? 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock (repurchase). 5. Buy nonoperating assets (e.g., marketable securities, investments in other companies, etc.)

35. 35 Earning before interest and taxes (1 Tax rate) Net operating profit after taxes X Operating current assets Operating current liabilities Net operating working capital Total net operating capital Operating long-term assets + Net operating working capital Free cash flow Net investment in operating capital Net operating profit after taxes Total net operating capital this year Total net operating capital last year Net investment in operating capital Calculating Free Cash Flow in 5 Easy Steps Step 1 Step 2 Step 3 Step 4 Step 5

36. 36 Step1: Net Operating Profit after Taxes (NOPAT) NOPAT = EBIT(1 - Tax rate) =EBIT - Tax

37. 37 Step2: Net Operating Working Capital (NOWC) Operating CA = cash and equivalent + inventory + accounts receivables. Operating CL = accounts payable + accruals = - Operating CA Operating CL NOWC

38. 38 Step 3: Total net operating capital (or operating capital) Operating Capital = NOWC + Net fixed assets.

39. Step 4: net investment in operating capital Net investment in operating capital = operating capital this year - operating capital last year 39

40. 40 Step 5: Free Cash Flow (FCF) FCF = NOPAT - Net investment in operating capital Equation (2-6)

41. Alternative FCF equation (2-9) 41 FCF = operating cash flow - gross investment in long-term operating asset - investment in NOWC Equation (2-9)

42. Is a negative FCF bad? If NOPAT leads to a FCF, then bad. High growth usually causes negative FCF (due to investment in capital), but thats ok if ROIC > WACC. ROIC: return on invested capital ROIC = NOPAT / operating capital 42

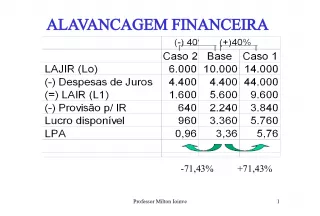

43. 43 Market Value Added (MVA) MVA = Market Value of the Firm - Book Value of the Firm Market Value = (# shares of stock)(price per share) + Value of debt Book Value = Total common equity + Value of debt

44. 44 MVA (Continued) If the market value of debt is close to the book value of debt, then MVA = Market value of equity book value of equity This applies when it is hard to find the market value of debt.

45. 45 MVA (Assume market value of debt = book value of debt.) Market Value of Equity 2010: (100,000)($6.00) = $600,000. Book Value of Equity 2010: $557,632. MVA = $600,000 - $557,632 = $42,368.

46. 46 Economic Value Added (EVA) EVA = NOPAT Operating capital x WACC = Operating capital x ROIC Operating capital x WACC = Operating capital (ROIC-WACC)

47. MVA and EVA (Table 2-5) 47 Table 2-5 MVA and EVA for MicroDrive (Millions of Dollars) 2010 2009 MVA Calculation Price per share $23.0 $26.0 Number of shares (millions) 50.0 50.0 Market value of equity = Share price (number of shares) $1,150.0 $1,300.0 Book value of equity $896.0 $840.0 MVA = Market value - Book value $254.0 $460.0 EVA Calculation EBIT $283.8 $263.0 Tax rate 40% 40% NOPAT = EBIT (1-T) $170.3 $157.8 Total investor-supplied operating capital a $1,800.0 $1,455.0 Weighted average cost of capital, WACC (%) 11.0% 10.8% Dollar cost of capital = Operating capital (WACC) $198.0 $157.1 EVA = NOPAT Capital cost -$27.7 $0.7 ROIC = NOPAT/Operating capital 9.46% 10.85% ROIC Cost of capital = ROIC WACC -1.54% 0.05% EVA = (Operating capital)(ROIC WACC) -$27.7 $0.7

48. 48 2009 Corporate Tax Rates Taxable Income Tax on Base Rate on amount above base 0 -50,000 0 15% 50,000 - 75,000 7,500 25% 75,000 - 100,000 13,750 34% 100,000 - 335,000 22,250 39% 335,000 - 10M 113,900 34% 10M - 15M 3,400,000 35% 15M - 18.3M 5,150,000 38% 18.3M and up 6,416,667 35%

49. 49 Features of Corporate Taxation Progressive rate up until $18.3 million taxable income. Below $18.3 million, the marginal rate is not equal to the average rate. Above $18.3 million, the marginal rate and the average rate are 35%.

50. After Chapter Homework Problems: (2-3), (2-4), (2-5), (2-10), (2-12 abcde), mini case d,e,f,g,h. Course website: Statement of Cash Flow assignment 3.2, 3.3. 50