Taxing and Spending: How the Government Raises Money

This political science unit delves into the various ways in which the government raises revenue to fund its operations. The unit focuses on taxes as the primary means of revenue collection and discusses

- Uploaded on | 1 Views

-

lauracastro

lauracastro

About Taxing and Spending: How the Government Raises Money

PowerPoint presentation about 'Taxing and Spending: How the Government Raises Money'. This presentation describes the topic on This political science unit delves into the various ways in which the government raises revenue to fund its operations. The unit focuses on taxes as the primary means of revenue collection and discusses. The key topics included in this slideshow are . Download this presentation absolutely free.

Presentation Transcript

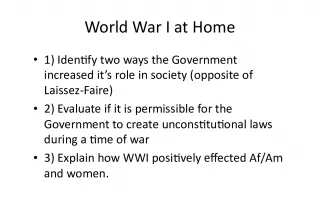

Slide1Political Science, Unit 7

Slide2TAXING & SPENDINGHOW DOES THE GOVERNMENT RAISE MONEY? 1) TAXES a. Progressive Individual Income Tax b. Corporate Income Tax c. Social Insurance Taxes d. Excise Taxes e. Customs Duties f. Estate and Gift Taxes

Slide3TAXING & SPENDINGHOW DOES THE GOVERNMENT RAISE MONEY? 2) BORROWING FOR REVENUE a. Bonds & Securities b. National debt

Slide4KEY TERMS TO KNOWTaxes Taxable income Dependent Witholding Self-employment Internal Revenue Service April 15

Slide5THE FEDERAL BUDGETOperates in a FISCAL YEAR, from October 1 of one year to September 30 of the next year STEPS: 1. Executive branch agencies develop requests, send them to the Office of Management and Budget (OMB) - President draws up a budget 2. Budget document submitted to Congress – Congress must approve spending and revenue bills – Congress passes a budget

Slide6Managing the EconomyGovernment spending: $4.6 billion in 1933 $2 trillion today WHERE THE MONEY GOES: 1. Direct benefit payments 2. National Defense 3. Discretionary spending

Slide7FISCAL & MONETARY POLICYFISCAL POLICY: government spending and taxation MONETARY POLICY: controlling the supply of money and credit (through the Federal Reserve System) FEDERAL RESERVE: central banking system of the United States (“banker’s bank”)

Slide8SUMMARYREVENUE (taxes, duties, borrowing) --- FEDERAL BUDGET --- EXPENDITURES (social security, welfare, health; defense; discretionary spending)

Slide9SOCIAL & DOMESTIC POLICYBUSINESS AND LABOR POLICY 1. The federal government promotes and protects business 2. The federal government regulates business 3. The federal government protects consumers

Slide10SOCIAL & DOMESTIC POLICYAGRICULTURE AND ENVIRONMENTAL POLICY 1. The federal government is involved in American agriculture (Department of Agriculture; various farm laws to support prices, allot acreage, promote conservation) 2. The federal government protects the environment (pollution regulations, other laws)

Slide11HEALTH & PUBLIC ASSISTANCESOCIAL INSURANCE PROGRAMS 1. Social Security 2. Medicare / Medicaid 3. Unemployment insurance 4. Aid to Families with Dependent Children 5. Welfare

Slide12EDUCATION & HOUSINGPUBLIC EDUCATION PROGRAMS Federal aid to education Aid to Public Schools HOUSING & URBAN PROGRAMS Federal Housing Administration (FHA) Urban renewal

Slide13TRANSPORTATIONDepartment of Transportation Federal Aviation Administration Federal Highway Administration

Slide14FOREIGN POLICY AND DEFENSEFOREIGN POLICY: strategies and goals that guide our nation’s relations with other countries and groups in the world GOALS OF FOREIGN POLICY 1. National Security 2. Free and open trade 3. World peace 4. Aiding democratic governments 5. Humanitarian concern

Slide15MODERN FOREIGN POLICY AGENDAPERSIAN GULF WAR WAR ON TERRORISM Preemptive strategy Iraq War

Slide16FOREIGN POLICY IN ACTIONMUTUAL DEFENSE ALLIANCES: nations sign agreements to protect one another NORTH ATLANTIC TREATY ORGANIZATION (NATO) – Unites States and western Europe FOREIGN AID – SANCTIONS – MILITARY FORCE