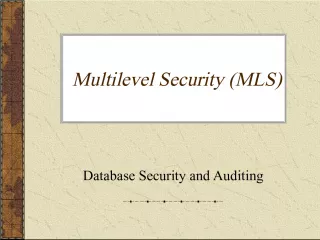

Primary vs Secondary Security Sales: Understanding How Firms Issue Securities

This article discusses the difference between primary and secondary security sales and how firms issue securities. In a primary sale, a new issue is issued, and the issuer receives

- Uploaded on | 1 Views

-

matilde

matilde

About Primary vs Secondary Security Sales: Understanding How Firms Issue Securities

PowerPoint presentation about 'Primary vs Secondary Security Sales: Understanding How Firms Issue Securities'. This presentation describes the topic on This article discusses the difference between primary and secondary security sales and how firms issue securities. In a primary sale, a new issue is issued, and the issuer receives. The key topics included in this slideshow are . Download this presentation absolutely free.

Presentation Transcript

Slide1Primary vs. Secondary Security SalesPrimary New issue Key factor: issuer receives the proceeds from the sale Secondary Existing owner sells to another party Issuing firm doesn’t receive proceeds and is not directly involved

Slide2How Firms Issue SecuritiesInvestment Banking Shelf Registration Private Placements Initial Public Offerings (IPOs)

Slide3Investment Banking ArrangementsUnderwritten vs. “Best Efforts” Underwritten: firm commitment on proceeds to the issuing firm Best Efforts: no firm commitment Negotiated vs. Competitive Bid Negotiated: issuing firm negotiates terms with investment banker Competitive bid: issuer structures the offering and secures bids

Slide4Figure 3.1 Relationship Among a Firm IssuingSecurities, the Underwriters and the Public

Slide5Initial Public OfferingsProcess Road shows : 1. generate interest among potential investors and provide information about the offering. 2. provide price information to the issuing firm and its underwriters. Bookbuilding : process of polling potential investors Underpricing Post sale returns Cost to the issuing firm

Slide6Figure 3.4 Long-term Relative Performanceof Initial Public Offerings

Slide7Stock Market Order TypesLimit order Buy at best price available, but not more than the preset limit price. Forgo purchase if limit is not met. Sell at best price available, but not less than the preset limit price. Forgo sale if limit is not met. Type Market order Buy at best price available for immediate execution. Sell at best price available for immediate execution. Buy Sell Stop orders convert to a market order to buy when the stock price crosses the stop price from below. convert to a market order to sell when the stock price crosses the stop price from above

Slide8Limited Order and Stop orderEx. Stock A selling $25: a limit buy @ $23 [instruct the broker to buy when price falls below $23]; a limit sell @$27 [to sell when price goes above $27] Stop-loss (sell) orders [ex. Stop sell @$20]: to sell if price falls a stipulated level to sell to stop further losses from accumulating Stop-buy orders [ex. Stop buy at @$30]: to buy when price rises above a given limit accompany short sales, to limit potential losses from the short position (problem 20 , 2 1 )

Slide9Order Specification and TradingMechanisms Order specification name of Company buy or sell size of order (odd lots = less than 100 shares; round lots = 100 shares) how long is order to be outstanding (when expires) types of order Dealer markets Electronic communication networks (ECNs) Specialists markets

Slide10U.S. Security MarketsNasdaq Small stock OTC Pink sheets Organized Exchanges New York Stock Exchange American Stock Exchange Regionals Electronic Communication Networks (ECNs) National Market System

Slide11OTC (Nasdaq)No central physical location No membership requirements for trading: brokers register with the SEC as dealers in OTC dealer market: quote bid & asked prices and execute, over 400 market makers note: bid (asked) price: at which a dealer is willing to purchase (sell) about 35,000 issues are traded NASD (National Association of Sec. Dealers) oversees trading of OTC securities in 1971, the NASDAQ system began The Nasdaq composite Index includes about 3,400 companies (about 5,000 companies in 2000) whose weight in the index is based on market capitalization Nasdaq operates two market segments: Nasdaq National Market and Nasdaq SmallCap Market (listing requirements differ)

Slide12New York Stock ExchangeA facility (central physical location) Only members may trade The NYSE membership is limited to 1,366 members since 1953, who collectively own the NYSE. The NYSE represents approximately 80% of the value of all publicly owned companies in America. Memberships (or seats) are valuable assets ($1 mil:1/6/2005, $1.7 mil: 4/3/00, $2 mil in 2003) Member functions Commission brokers Floor brokers Specialists

Slide13Margin TradingUsing only a portion of the proceeds for an investment Borrow remaining component Margin arrangements differ for stocks and futures Margin is the net worth of the investor’s account

Slide14Stock Margin TradingMaximum margin is currently 50%; you can borrow up to 50% of the stock value Set by the Fed Maintenance margin : minimum amount equity in trading can be before additional funds must be put into the account Margin call : notification from broker you must put up additional funds

Slide15Margin Trading - Initial ConditionsX Corp $70 50% Initial Margin 40% Maintenance Margin 1000 Shares Purchased Initial Position Stock $70,000 Borrowed $35,000 Equity 35,000

Slide16Margin Trading - Maintenance MarginStock price falls to $60 per share New Position Stock $60,000 Borrowed $35,000 Equity 25,000 Margin% = Equity/Asset =$25,000/$60,000 = 41.67%

Slide17Margin Trading - Margin CallHow far can the stock price fall before a margin call? (1000P - $35,000) * / 1000P = 40% P = $58.33 * 1000P - Amt Borrowed = Equity

Slide18Short Sales Purpose : to profit from a decline in the price of a stock or security Mechanics Borrow stock through a dealer Sell it and deposit proceeds and margin in an account. allowed only after an ‘uptick’ ( P > 0) Closing out the position: buy the stock and return to the party from which is was borrowed

Slide19Short SalesExample: Short Sales You want to short 100 Sears shares at $30 per share. Your broker has a 50% initial margin and a 40% maintenance margin on short sales. Worth of stock borrowed = $30 × 100 = $3,000 Liabilities & Account Equity Assets Proceeds from sale $3,000 Short position $ 3,000 Initial margin deposit 1,500 Account equity 1,500 Total $4,500 Total $4,500

Slide20Short SalesExample: Short Sales … continued Scenario 1: The stock price falls to $20 per share. Liabilities & Account Equity Assets Proceeds from sale $3,000 Short position $ 2,000 Initial margin deposit 1,500 Account equity 2,500 Total $4,500 Total $4,500 New margin = equity/short position = $2,500 / $2,000 = 125%

Slide21Short SalesExample: Short Sales … continued Scenario 2: The stock price rises to $40 per share. Liabilities & Account Equity Assets Proceeds from sale $3,000 Short position $ 4,000 Initial margin deposit 1,500 Account equity (A-L) 500 Total $4,500 Total $4,500 New margin = equity/short position=$500 / $4,000 = 12.5% < 40% Therefore, you are subject to a margin call.

Slide22Short Sale - Initial ConditionsZ Corp 100 Shares 50% Initial Margin 30% Maintenance Margin $100 Initial Price Sale Proceeds $10,000 Margin & Equity 5,000 Stock Owed 10,000

Slide23Short Sale - Maintenance MarginStock Price Rises to $110 Sale Proceeds $10,000 Initial Margin 5,000 Stock Owed 11,000 Net Equity 4,000 Margin % (4000/11000) 36%

Slide24Short Sale - Margin CallHow much can the stock price rise before a margin call? ($15,000 * - 100P) / (100P) = 30% P = $115.38 * Initial margin plus sale proceeds

Slide25Example 23Assume you purchased 200 shares of XYZ common stock on margin at $80 per share from your broker. If the initial margin is 60%, the amount you borrowed from the broker is __________. A) $4000 B) $6400 C) $9600 D) $16,000 You short-sell 200 shares of Tuckerton Trading Co., now selling for $50 per share. What is your maximum possible gain ignoring transactions cost? A) $50 B) $150 C) $10,000 D) unlimited