Understanding Risk Attitude and Utility Theory in Decision Making

This article explores the concept of risk attitude and utility theory in decision making. It discusses the challenge of capturing the value of alternatives, introduces the Certainty Equivalent (CE) and Risk Premium (RP), and explains how risk aversion and risk prone behaviors are shaped by utility functions. The article also examines the limitations of the utility theory and highlights the paradoxes and prospects of the alternate Prospect Theory.

- Uploaded on | 3 Views

-

tammi

tammi

About Understanding Risk Attitude and Utility Theory in Decision Making

PowerPoint presentation about 'Understanding Risk Attitude and Utility Theory in Decision Making'. This presentation describes the topic on This article explores the concept of risk attitude and utility theory in decision making. It discusses the challenge of capturing the value of alternatives, introduces the Certainty Equivalent (CE) and Risk Premium (RP), and explains how risk aversion and risk prone behaviors are shaped by utility functions. The article also examines the limitations of the utility theory and highlights the paradoxes and prospects of the alternate Prospect Theory.. The key topics included in this slideshow are Risk Attitude, Utility Theory, Certainty Equivalent, Risk Premium, Risk Aversion, Risk Prone, Prospect Theory,. Download this presentation absolutely free.

Presentation Transcript

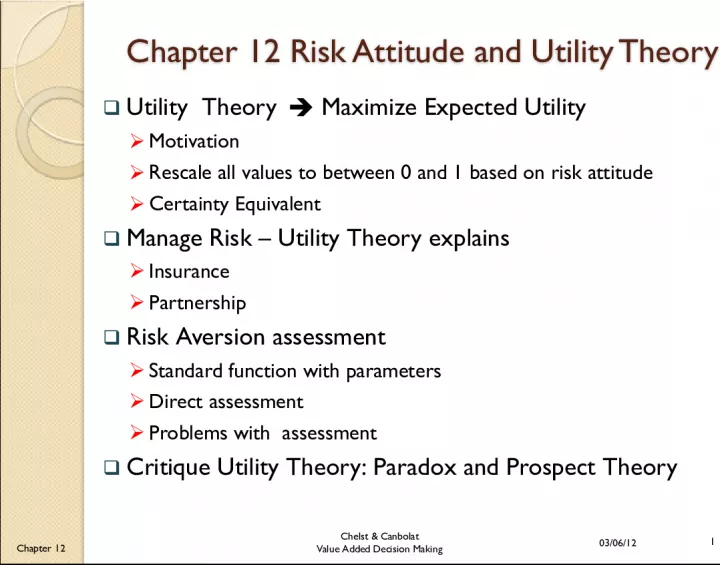

1. Chelst & Canbolat Value Added Decision Making 03/06/12 1 Chapter 12 Chapter 12 Risk Attitude and Utility Theory Chapter 12 Risk Attitude and Utility Theory Utility Theory Maximize Expected Utility Motivation Rescale all values to between 0 and 1 based on risk attitude Certainty Equivalent Manage Risk Utility Theory explains Insurance Partnership Risk Aversion assessment Standard function with parameters Direct assessment Problems with assessment Critique Utility Theory: Paradox and Prospect Theory

2. Chelst & Canbolat Value Added Decision Making 03/06/12 2 Chapter 12 Utility Theory - Overview Utility Theory - Overview Incorporates decision-makers risk attitude Value of alternatives cannot be captured by E(X) because risk attitude Certainty Equivalent (CE) : The payoff amount we would accept in lieu of under-going the uncertain situation, taking a gamble. Risk Premium : A situations risk premium (RP) is the difference between expected payoff (EP) and certainty equivalent (CE) Risk Aversion: CE < E(X) Concave function Profit prefer sure profit that is less than E(X) of a profit gamble Cost prefer sure cost that is higher than E(Y) of a loss gamble Risk Prone: CE > E(X) Try for more money than average With high guaranteed minimum, may be will to try for home run even if offered a value somewhat higher than the expected value

3. Chelst & Canbolat Value Added Decision Making 03/06/12 3 Chapter 12 TV show Deal or No Deal Activate WEB GAME Game Description and Risk Attitude TV show Deal or No Deal Activate WEB GAME Game Description and Risk Attitude Game starts with 26 suitcases, each with a dollar value ranging from $0.01 to $1M Contestant picks one case as his to be opened at the end, and selects 6 cases to be opened immediately. As they are opened, their stored dollar value is deleted from the list. After opening these six cases, the player is offered a sure amount or the option to keep playing. At each the step the number of boxes to open at this stage decreases until only one at a time is opened each time. For example, I played the game until there were 3 unopened boxes left ($25, $50,000, and $1,000,000). One of these boxes I had selected as my box. The offer was for $220,000. This is much less than the expected value E(X) = (1/3)(25)+ (1/3)((50,000) + (1/3)(1,000,000) = (1/3) (1,000,025) = $350,008 If you prefer to take less than the expected value risk averse

4. Chelst & Canbolat Value Added Decision Making 03/06/12 4 Chapter 12 Simple gamble (lottery) Two Outcomes Two boxes are left: $10,000 and $20,000. Simple gamble (lottery) Two Outcomes Two boxes are left: $10,000 and $20,000. You have a 5050 chance of winning $10,000 or $20,000 depending upon what is in your selected box. E(X) = $15,000 Would you accept an offer of $12,000 or continue Yes __ or No __ Would you accept an offer of $14,500 or continue Yes __ or No __ What is the minimum you would accept to stop the game? ___ this is Certainty Equivalent (CE) of the gamble If the CE is less than the expected value, you are a risk averse. Risk Premium is the difference between your CE and the expected value Assume you would accept $12,500 Risk Premium = E(X) CE = $15,000 - $12,500 = $2,500 If the CE is more than the expected value, you are a risk prone. Gamble is a set of uncertain outcomes with probabilities Not necessarily just 2 outcomes All outcomes may not have the same probability.

5. Chelst & Canbolat Value Added Decision Making 03/06/12 5 Chapter 12 Expected Value is Inadequate Generally Risk Averse Expected Value is Inadequate Generally Risk Averse Extremely Rare Catastrophic Events Law of averages no help for individual Motivates insurance industry Companies may self-insure up to extreme costs Can tolerate moderate risks that are not devastating Deductible on insurance Large investments relative to size of company Cannot afford the loss Has need for certain profit more than high upside potential sell development rights

6. Chelst & Canbolat Value Added Decision Making 03/06/12 6 Chapter 12 Determine function U(X) Determine function U(X) U(X) function may be determined Select from standard functional forms exponential or logarithmic and estimate parameters from questions Brute force graphing of the results of series of Certainty Equivalent responses to gambles Assume exponential U(X) = 1-e (-x/15000) U(20,000) = 1-e (-20000/15000) = .7364

7. Chelst & Canbolat Value Added Decision Making 03/06/12 7 Chapter 12 Calculate Expected Utility E(U(X)) and Not E(X) Assume exponential utility function for this example Calculate Expected Utility E(U(X)) and Not E(X) Assume exponential utility function for this example (0.5) (0.5) $20,000 $10 ,000 E(X) = 0.5($10000) + 0.5($20000) = $12,500 (0.5) (0.5) 0.7364 0.4866 E(U(X)) = 0.5(0.487) + 0.5(0.736) = 0.6115 invert exponential function CE(0.6115) = $14,182 $14,250 would be preferred to gamble $14,000 would not be preferred Assume U(X) = 1-e (-x/15000) U(10,000) = 1-e (-10000/15000) = 0.4866 U(20,000) = 1-e (-20000/15000) = 0.7364

8. Chelst & Canbolat Value Added Decision Making 03/06/12 8 Chapter 12 Invert function U(X) U -1 (X) Invert function U(X) U -1 (X) 0.6115 = 1-e (-x/15000) e (-x/15000) = 1- 0.6115 = 0.3885 ln of both sides (-X/15000) = ln(0.3885) = -0.9455 X = 15000 (0.9455) = 14,182 CE of 50-50 gamble of 10,000 and 20,000 is $14,182 Risk Premium = $15,000 - $14,182 = $818

9. Chelst & Canbolat Value Added Decision Making 03/06/12 9 Chapter 12 Risk Aversion Risk Aversion CONCAVE for Negative (Cost) Prefer to PAY More than expected value to be sure Cost does not get too large . 50-50 COST Gamble $90,000 or $10,000 => prefer sure $60,000 cost Basis for Insurance Industry CONCAVE for Maximization (Profit) Prefer to EARN less than expected value to be sure of earning at least that profit. 50-50 PROFIT Gamble $90,000 or $10,000 ===> would prefer sure $40,000 profit to the gamble. Basis for Selling off bank Debts such as mortgages

10. Chelst & Canbolat Value Added Decision Making 03/06/12 10 Chapter 12 Risk Aversion Concave Curve Risk Aversion Concave Curve 0.5 for $10,000 or 0.5 for $90,000 E(X) = $50,000 Accept $40,000 = CE U(40000)=.5 Risk Premium $10,000 0.5 for -$10,000 or 0.5 for -$90,000 E(X) = -$50,000 Accept -$60,000 = CE U(60000)=.5 Risk Premium $10,000 Profit Cost

11. Chelst & Canbolat Value Added Decision Making 03/06/12 11 Chapter 12 Activity Risk Aversion Activity Risk Aversion Pay to avoid loss ___________________________________________ ___________________________________________ Accept less profit but be sure (or more certain) of profit ___________________________________________ ___________________________________________ Other Examples ___________________________________________ ___________________________________________ ___________________________________________ ___________________________________________

12. Chelst & Canbolat Value Added Decision Making 03/06/12 12 Chapter 12 Utility Function Assessment Brute Force Utility Function Assessment Brute Force Series of 3 lotteries Obtain Certainty Equivalent of utility values of .25, .5, & .75 Extrapolate over the range of 0 to 1. Create your own utility function for $0M to $10M set U(min) = 0 & U(max) = 1 set U(0) = 0 & U(10) = 1

13. Chelst & Canbolat Value Added Decision Making 03/06/12 13 Chapter 12 Decision tree Boss Controls automation investment Need utility function for four values ( 0.8, 1.9, 8.5, 10 ) Decision tree Boss Controls automation investment Need utility function for four values ( 0.8, 1.9, 8.5, 10 ) 40.0% 0 9.9 1.9 FALSE Take Rate -8 5.86 60.0% 0 16.5 8.5 How Much 6.32 40.0% 0.4 13.8 0.8 TRUE Take Rate -13 6.32 60.0% 0.6 23 10 Automation Investment Low High 30% Take 50% Take 50% Take 30% Take

14. Chelst & Canbolat Value Added Decision Making 03/06/12 14 Chapter 12 Certainty equivalents Certainty equivalents (0.5) (0.5) X H X L CE50 (0.5) (0.5) CE50 X L CE25 (0.5) (0.5) CE50 X H CE75

15. Chelst & Canbolat Value Added Decision Making 03/06/12 15 Chapter 12 BC automation investment certainty equivalent for 0.50, 0.25, and 0.75 utility BC automation investment certainty equivalent for 0.50, 0.25, and 0.75 utility (0.5) (0.5) 3.6 0 CE25 = 1.6 (0.5) (0.5) 3.6 10 CE75 = 6.2 (0.5) (0.5) 10 0 CE50 = 3 .6

16. Chelst & Canbolat Value Added Decision Making 03/06/12 16 Chapter 12 Utility assessment for BC automation investment example Utility assessment for BC automation investment example Value 0 0.8 1.6 1.9 3.6 6.2 8.5 10 Utility 0 0.13 0.25 0.29 0.5 0.75 0.90 1 Table 12 4: Utility scores for BC automation investment

17. Chelst & Canbolat Value Added Decision Making 03/06/12 17 Chapter 12 Decision tree for BC automation investment using utility function Decision tree for BC automation investment using utility function CE: $5.142 ( 0.652 ) vs. $5.196 million ( 0.657 ) 40% 0 0.13 0.13 FALSE Take Rate 0.652 60% 0 1.0 1.0 Decision 0.657 40% 0.4 0.29 0.29 TRUE Take Rate 0.657 60% 0.6 0.9 0.90 High Low 30% Take Rate 50% Take Rate 30% Take Rate 50% Take Rate Automation Investment

18. Chelst & Canbolat Value Added Decision Making 03/06/12 18 Chapter 12 Utility Function: Simplify Interview Utility Function: Simplify Interview Goal: simplify interview process One question for each parameter Exponential U(x) = 1 exp(-x/R) Constant Risk Aversion Implies that the magnitude of cash on hand does not affect attitude towards Risk R = Risk Tolerance R = Sum of Money about which you are indifferent between a 50-50 chance of gaining the whole sum, R and losing the half sum, R/2

19. Chelst & Canbolat Value Added Decision Making 03/06/12 19 Chapter 12 Constant Risk Aversion Risk Premium is Constant Constant Risk Aversion Risk Premium is Constant R=35 U(X) = 1 exp(-x/35)

20. Chelst & Canbolat Value Added Decision Making 03/06/12 20 Chapter 12 Determine R = Risk Tolerance Determine R = Risk Tolerance 50- 50 gamble to determine R Personal

21. Chelst & Canbolat Value Added Decision Making 03/06/12 21 Chapter 12 Determine R = Risk Tolerance Determine R = Risk Tolerance Corporate 50- 50 gamble to determine R

22. Chelst & Canbolat Value Added Decision Making 03/06/12 22 Chapter 12 ENCO Project Selection ENCO Project Selection An energy company will select one of two projects. If the company chooses Project A, it will undertake the development of a new power plant in one developing country. The company estimates that the investment cost will be $50 million and total revenue for five-year after the operation cost will be $80, $90, or $110 million. There is a 20% chance that the local government will take over the plant once it is finished due to some legal issues and just repay the original investment cost ($50 million). Project B also requires a $50 million investment. Total revenue for five-year after the operation cost will be $66, $80, or $90 million. In this second country, there is no chance that the government will take over this project when it is completed.

23. Chelst & Canbolat Value Added Decision Making 03/06/12 23 Chapter 12 Maximize expected value Decision tree for ENCO project selection Maximize expected value Decision tree for ENCO project selection

24. Chelst & Canbolat Value Added Decision Making 03/06/12 24 Chapter 12 Figure 12.11: Cumulative risk profile for ENCO project selection Redraw diagram without student version Figure 12.11: Cumulative risk profile for ENCO project selection Redraw diagram without student version

25. Chelst & Canbolat Value Added Decision Making 03/06/12 25 Chapter 12 A utility score was calculated for each value. R= $30 million A utility score was calculated for each value. R= $30 million EU(Project A) = 0*20% + (0.632*30%+0.736*40%+0.865*30%)*80% = 0.595 EU(Project B) = 0.413*30%+0.632*40%+0.736*30% = 0.598

26. Chelst & Canbolat Value Added Decision Making 03/06/12 26 Chapter 12 Decision tree for ENCO: using expected utility Decision tree for ENCO: using expected utility 20.0% 0 50 0.000 FALSE Government Take Project? - 50 30.0% 0 80 0.632 80.0% Revenue 0 0.744 40.0% 0 90 0.736 30.0% 0 110 Project Decision 30.0% 0.3 66 0.413 TRUE Revenue - 50 0.598 40.0% 0.4 80 0.632 30.0% 0.3 90 0.736 Project Project A Project B Yes No Low Medium High Low High Medium 20.0% 0 50 0.000 FALSE - 50 0.595 30.0% 0 80 0.632 80.0% Revenue 0 0.744 40.0% 0 90 0.736 30.0% 0 110 Project Decision 30.0% 0.3 66 0.413 TRUE Revenue - 50 0.598 40.0% 0.4 80 0.632 30.0% 0.3 90 0.736 Project Project A Project B Yes No Low Medium High Low High Medium 0.598 0.865

27. Chelst & Canbolat Value Added Decision Making 03/06/12 27 Chapter 12 Impact of risk tolerance on certainty equivalent Impact of risk tolerance on certainty equivalent

28. Chelst & Canbolat Value Added Decision Making 03/06/12 28 Chapter 12 Risk Sharing Strategies Risk Sharing Strategies Buy insurance Partnerships Example: Transmission plant by GM and Ford Joint ventures with foreign companies Diversification Diversification with independent investments Example: Dual sourcing, investment in different stocks Diversification with dependent investments (Hedging)

29. Chelst & Canbolat Value Added Decision Making 03/06/12 29 Chapter 12 Risk Sharing through Buy Insurance : Project Selection Risk Sharing through Buy Insurance : Project Selection Buy insurance against a government takeover of project A. $4 million premium the company will receive a $10 million payment if the government takes the project. Add new decision branch to tree as part of Project A. (top of next tree)

30. Chelst & Canbolat Value Added Decision Making 03/06/12 30 Chapter 12 ENCO: insurance reporting expected value ENCO: insurance reporting expected value 20.0% 0 60 6 FALSE Government Take Project? -4 32.400 30.0% 0 80 26 80.0% Revenue 0 39.000 40.0% 0 90 36 30.0% 0 110 56 TRUE Insurance Decicion -50 34.400 20.0% 0.2 50 0 TRUE Government Take Project? 0 34.400 30.0% 0.24 80 30 80.0% Revenue 0 43.000 40.0% 0.32 90 40 30.0% 0.24 110 60 Project Decision 34.400 30.0% 0 66 16 FALSE Revenue -50 28.800 40.0% 0 80 30 30.0% 0 90 40 Project Insurance Project A Project B Buy Insurance Do Not Buy Yes No Yes No Low Medium High Low Medium High Low Medium High

31. Chelst & Canbolat Value Added Decision Making 03/06/12 31 Chapter 12 ENCO : insurance option reporting CE ENCO : insurance option reporting CE 20.0% 0.2 60 6 TRUE Government Take Project? -4 27.630 30.0% 0.24 80 26 80.0% Revenue 0 36.830 40% 0.32 90 36 30.0% 0.24 110 56 TRUE Insurance Decision -50 27.630 20.0% 0 50 0 FALSE Government Take Project? 0 27.107 30.0% 0 80 30 80.0% Revenue 0 40.830 40.0% 0 90 40 30.0% 0 110 60 Project Decision 27.630 30.0% 0 66 16 FALSE Revenue -50 27.322 40.0% 0 80 30 30.0% 0 90 40 Yes No Buy Insurance Low Medium High Do Not Buy Yes No Project A Project B Project Insurance Low Medium High Low Medium High

32. Chelst & Canbolat Value Added Decision Making 03/06/12 32 Chapter 12 Decision Tree for Insurance company Tree Not in Textbook Decision Tree for Insurance company Tree Not in Textbook

33. Chelst & Canbolat Value Added Decision Making 03/06/12 33 Chapter 12 Share Risk through Partnership Share Risk through Partnership Concept: Commit to only a percentage of the cost (liability) and accrue the equivalent percentage of revenue Common amongst insurance companies to reinsure and share risk of catastrophic event Lloyds of London Decision Tree Method reduce costs and revenues proportionate to share and calculate new utility scores.

34. Chelst & Canbolat Value Added Decision Making 03/06/12 34 Chapter 12 Share Risk through Partnership: Project Selection Share Risk through Partnership: Project Selection Outside investor shares 50% of cost and benefit of each project. By sharing the investment, the company can now be involved in more projects. Lets evaluate a 50% share. As a result the company can invest in BOTH A and B.

35. Chelst & Canbolat Value Added Decision Making 03/06/12 35 Chapter 12 ENCO with 50% partnership reporting expected profit ENCO with 50% partnership reporting expected profit Project - Diversification 50% of Both Projects Yes No Low Medium High Low High Medium Low High Medium

36. Chelst & Canbolat Value Added Decision Making 03/06/12 36 Chapter 12 ENCO decision tree with partnership option reporting certainty equivalent ENCO decision tree with partnership option reporting certainty equivalent

37. Chelst & Canbolat Value Added Decision Making 03/06/12 37 Chapter 12 Optimize PERCENT Share of Project Optimize PERCENT Share of Project Can optimize based on risk attitude Percent share of option A Percent share of option B Different companies with different risk attitudes will have different optimum preferences

38. Chelst & Canbolat Value Added Decision Making 03/06/12 38 Chapter 12 Phillips Petroleum and Onshore US Oil Exploration Prospect Ranking: R equal to $25 million Phillips Petroleum and Onshore US Oil Exploration Prospect Ranking: R equal to $25 million Expected Value Basis Certainty Equivalent Basis Prospect Rank EV 100% share Rank Optimal Share Certainty Equivalent South Louisiana 1 18.6 8 12.5% 0.6 Norphlet 2 16.5 6 12.5% 0.8 Wilcox 3 11.8 5 25% 0.8 Frio 4 10.8 7 12.5% 0.7 Vicksburg 5 4.0 4 75% 1.0 Yegua Deep 6 3.0 3 100% 1.0 Smackover 7 2.5 1 100% 1.8 Yegua Shallow 8 2.2 2 100% 1.1

39. Chelst & Canbolat Value Added Decision Making 03/06/12 39 Chapter 12 Following two slides not in the textbook Following two slides not in the textbook Impacts of the target setting on the risk attitude Consistent with prospect theory

40. Chelst & Canbolat Value Added Decision Making 03/06/12 40 Chapter 12 Risk Attitude and Targets Component Cost Target $46 Goal: Minimize Cost Risk Attitude and Targets Component Cost Target $46 Goal: Minimize Cost You are near completion on a design and are almost certain that you will be able to reach the variable cost target of $46. A suggestion comes along that by changing materials the component should be easier to manufacture with the cost dropping to $40 per part. However, time is short and there is a concern that without proper testing of Design for Manufacture the change could, in fact, increase the cost to $47 per component and miss the target. Would you make the change assuming the two outcomes were equally likely? $40 $47 .5 .5 $46 OR

41. Chelst & Canbolat Value Added Decision Making 03/06/12 41 Chapter 12 You are near completion on a design and are almost certain that you will NOT be able to reach the variable cost target of $40 and that the part will cost $42. A suggestion comes along that by changing materials the part should be easier to manufacture with the cost dropping to $40 per part. However, time is short and there is a concern that without proper testing of Design for Manufacture the change could, in fact, increase the cost to $47 per part and miss the target. Would you make the change assuming the two outcomes were equally likely? Risk Attitude and Targets Component Cost Target $ 40 Risk Attitude and Targets Component Cost Target $ 40 $40 $47 .5 .5 $42 OR

42. Chelst & Canbolat Value Added Decision Making 03/06/12 42 Chapter 12 Problems With Carrying Out Risk Aversion Assessment in Real-World Problems With Carrying Out Risk Aversion Assessment in Real-World Managers are uncomfortable with this abstract concept Managers are inconsistent -- Prefer ranges for CE and not specific values People are inconsistent risk prone for small values ( i.e. will buy lottery tickets) risk averse for large values (i.e. buy insurance) May be risk prone if values are negative but risk averse if all values are positive and vice versa Attitudes towards risk are influenced by artificial targets Target secure take no gamble to improve Target at risk take extreme gambles to reach target

43. Chelst & Canbolat Value Added Decision Making 03/06/12 43 Chapter 12 Risk Assessment In Practice (Done Less than 10% of the time) Risk Assessment In Practice (Done Less than 10% of the time) Howard Rule of Thumb for R in major decisions: R = 6.4% of sales or 1.25 Net Income Your company value? Example: R = $1 Billion dollar investment or purchase decision for a company with over $15 Billion in sales. First carry out analysis without Risk Aversion Display Comparative Risk Profiles and discuss Insert exponential function & determine whether or not the optimal solution is Sensitive to Risk Tolerance Value within a realistic range for your company. If optimal decision can change within a reasonable range of R then assess actual utility function.

44. Chelst & Canbolat Value Added Decision Making 03/06/12 44 Chapter 12 Assumptions of Utility Theory Assumptions of Utility Theory Expectation: U(x 1 ,p 1 ;;x n ,p n ) = p 1 u(x 1 )++p n u(x n ) Asset Integration: The domain of the utility function is final states (which include ones asset position) rather than gains or losses. Risk Aversion: u is concave (u< 0)

45. Chelst & Canbolat Value Added Decision Making 03/06/12 45 Chapter 12 Critique of Utility Theory Critique of Utility Theory Expectation Assumption - Allais paradox Problem 1: Choose between A: $1 Million with certainty B: $1 Million with probability 0.89 $5 Million with probability 0.10 0 with probability 0.01 Problem 2: Choose between X: $1 Million with probability 0.11 Y: $5 Million with probability 0.10 0 with probability 0.89 0 with probability 0.90

46. Chelst & Canbolat Value Added Decision Making 03/06/12 46 Chapter 12 Critique of Utility Theory- Actual preferences Critique of Utility Theory- Actual preferences Expectation Assumption - Allais paradox Problem 1: 82% choose A A: $1 Million with certainty B: $1 Million with probability 0.89 $5 Million with probability 0.10 0 with probability 0.01 Problem 2: 83% Choose Y X: $1 Million with probability 0.11 Y: $5 Million with probability 0.10 0 with probability 0.89 0 with probability 0.90 Conclusion: People overweight certain outcomes more than merely probable outcomes.

47. Chelst & Canbolat Value Added Decision Making 03/06/12 47 Chapter 12 Utility Function Stability and Accuracy Utility Function Stability and Accuracy Affected by mood Quality of life QOL Assessment of QOL living with serious disease.

48. Chelst & Canbolat Value Added Decision Making 03/06/12 48 Chapter 12 Prospect Theory (Kahneman and Tversky) Example not in textbook Prospect Theory (Kahneman and Tversky) Example not in textbook Value Function Concave for gains and Convex for losses; Steeper for losses than gains (Loss Aversion)

49. Chelst & Canbolat Value Added Decision Making 03/06/12 49 Chapter 12 Prospect Theory (Kahneman and Tversky) Example not in textbook Prospect Theory (Kahneman and Tversky) Example not in textbook Weighting Function (The impact of events on desirability of prospects, not merely the likelihood of events) Overweight certainty and small probabilities; Underweight moderate and high probabilities;

50. Chelst & Canbolat Value Added Decision Making 03/06/12 50 Chapter 12 Prospect Theory (Kahneman and Tversky) Example not in textbook Prospect Theory (Kahneman and Tversky) Example not in textbook Fourfold risk attitude: Small Probabilities Moderate or high probabilities Gains risk seeking risk averse Losses risk averse risk seeking

51. Chelst & Canbolat Value Added Decision Making 03/06/12 51 Chapter 12 Remember The Goal of Analysis Remember The Goal of Analysis Update Intuition of Decision Maker

52. Chelst & Canbolat Value Added Decision Making 03/06/12 52 Chapter 12 Where are we headed next? Where are we headed next? Analytic Tools completed! YEAH! No more new software! Data input: forecasting biases Structured expert interview Decision making biases awareness Ethics Decisions Negotiations Strategic Decisions & Scenario Planning Final Projects

53. Chelst & Canbolat Value Added Decision Making 03/06/12 53 Chapter 12 TREES-A Decision-Maker's Lament TREES-A Decision-Maker's Lament I think that I shall never see A decision as complex as that tree- A tree with roots in ancient days (At least as old as Reverend Bayes); A tree with trunk all gnarled and twisted With axioms by Savage listed; A tree with branches sprouting branches And nodes declaring what the chance is; A tree with flowers in its tresses (Each flower made of blooming guesses); A tree with utiles at its tips (Values gleaned from puzzled lips); A tree with stems so deeply nested Intuition's completely bested; A tree with branches in a tangle Impenetrable from any angle;

54. Chelst & Canbolat Value Added Decision Making 03/06/12 54 Chapter 12 TREES-A Decision-Maker's Lament TREES-A Decision-Maker's Lament A tree that tried to tell us "should" Although its essence was but "would"; A tree that did decision hold back 'Til calculation had it rolled back. Decisions are reached by fools like me, But it took a consultant to make that tree. Michael H. Rothkopf with apologies to Joyce Kilmer and to competent, conscientious decision analysts everywhere Operations Research Vol. 28, No. 1, January-February 1980