The Nordic Welfare States: Characteristics and Challenges

This article discusses the Nordic model of social protection, including universal benefits, earnings-related social insurance, and targeted benefits for the poor. It also covers the decentralized and separated nature of social services from cash benefits, individual social rights, taxation, and employment policies.

- Uploaded on | 1 Views

-

zacharyjones

zacharyjones

About The Nordic Welfare States: Characteristics and Challenges

PowerPoint presentation about 'The Nordic Welfare States: Characteristics and Challenges'. This presentation describes the topic on This article discusses the Nordic model of social protection, including universal benefits, earnings-related social insurance, and targeted benefits for the poor. It also covers the decentralized and separated nature of social services from cash benefits, individual social rights, taxation, and employment policies.. The key topics included in this slideshow are Nordic welfare, social protection, universal benefits, active labor market policies, taxation,. Download this presentation absolutely free.

Presentation Transcript

1. The Nordic Welfare States: Characteristics and Challenges Joakim Palme Institute for Futures Studies www.framtidsstudier.se

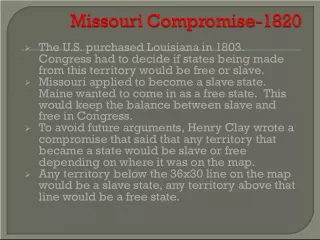

2. The Characteristics of the Nordic Welfare States

3. Nordic model of social protection Universal benefits Earnings-related social insurance Targeted benefits to poor Social services -universal -decentralized -separated from cash benefits Individual social rights Taxation Employer contributions Central/local taxes Local taxes with state subsidies Dual-earner model Full employment and active labor market policies

4. The merits of the model Low life-cycle poverty Reduced inequalities High employment High female participation Strong support for social security Incentives and cost control?!

5. Equality and efficiency Universal coverage combating poverty and exclusion Transaction costs - low with nationwide systems Portability good for labour mobility Incentive structure poverty traps avoided Investments in health and education productive labour force Stable institutions positive for growth: social rights as property rights Expenditure levels not the critical factor but program design

6. Rowntrees Poverty Cycle

7. Strategies of Redistribution Tawney - Welfare State as a Strategy of Equality Tullock and Le Grand - middle class inclusion damages the poor The Paradox of Redistribution Robin Hood Simple Egalitarianism Within Group Redistribution Mattews principle: Give to those who have

9. Shaping the Nordic Model Lenskis perspective on inequality: - inequalities in human societies are shaped by political conflicts as well as economic structures The emergence of universalism 1930s Population crisis and Depression Social citizenship Earning related social insurance Modern family policy - dual earner model What about ageing societies?

10. Peoples pension 1948

11. Peoples pension + ATP 1960

12. Peoples pension+ ATP + Supplement 1969-

13. The Great Pension Reform 1994/98 Ageing society Problems of cost control Incentive problems Individual choice in a compulsory system Political compromise in the most controversial policy field Defined contribution formula 18,5 % of income 16 % Notional Defined Contribution Accounts 2,5 % Fully Funded Accounts Pension Credits: child- rearing etc. Guarantee pension, no means-testing! Buffer funds and automatic balancing

14. Peoples pension+ ATP + Supplement 1969-

15. Reformed system: Income pension and universal guarantee (+supplement)

16. Dimensions and Models of Family Policy

17. Family policy generosity in different models of family policy in the mid- 1990s

18. Net parental leave benefits first year after confinement in 2000

19. Generosity of paid parental leave and poverty among families with infants

20. Erosion of the Nordic Model Nominal cost limits and insurance Choice, segregation and no voice Legitimacy and support Reforms and trust Social, occupational or fiscal welfare policy Grand coalition?

21. Organisation of social services Common trends: Decentralization Consumer-financing Privatization see graph right: Employment in private provision of publicly financed social services

22. Welfare and welfare institutions Welfare: Individual resources making it possible to control living conditions Several dimensions: health, work, income, education etc Institutions as individual resources: state, family , market Misfortune: social policy challenge Welfare institutions: Resoures for the individual as user Insurance for future needs Investment in the future Access and quality State, municipalities, market, voluntary sector, family

23. Common European Challenges

24. Common EU Trends in Family Formation Marriage Rate down Age at First Marriage up Age at First Birth up Extramarital Births up Divorce Rate up Female Labour Force Participation up Inequalities up Total Fertility Rate down

25. Rethinking social policy in ageing societies Social security is strongly redistributive over the life cycle: the ageing of societies puts tough fiscal pressures on public spending The debate on ageing issues has been overly focussed on pension reforms and savings How social policy interact with fertility, education and labour supply (the future tax base) is of vital concern We need to reform the system of social protection in order to make it sustainable for the future

26. Framework for reform: increase the number of taxpayers Incentives; individual taxation and rights, universal benefits and earnings-related social insurance vs. means-testing, Human resources ; lifelong learning starts at age 1 Social services ; child care, elderly care Employment opportunities ; goals and priorities of macro-economic policy, rehabilitation in social security

27. Personal desired fertility, 1989 and 2001, EU 15 (except Luxembourg) Source: EB 37.1 (1989) and EB 56.2 (2001)

28. Perceived Consequences of Family Formation among Europeans EU15 Questions in Eurobarometer 1998 Men <44 Women <44 Cut short education 5 13 Limited promotion chances 6 23 Reduced working time 6 37 Took a break with working life 4 41 Took a job below qualifications 5 15 Stopped working for good 2 25 Improved quality of life 80 70 Improved social networks 66 61

29. What Europeans think Governments should prioritise - to influence the number of children 1. Reducing unemployment, Flexible working hours, Childcare 2. Family allowances, Tax advantages 3. Cost of childrens education, Housing 4. Parental leave, Maternity benefits Source: Eurobarometer

30. Modernisation of European social policy should be about recasting: Gender and work in ageing societies

31. Open Method of Coordination Lisbon Strategy on Employment Sustainable pension systems Health insurance Social inclusion indicators Why not? Family policy and the rights of children

32. Why the founding principles of social security rights are important How benefits are distributed: coverage and adequcay How social security create interest coalitions and political support How social security programs may contribute to increase the number of taxpayers

33. The European Social Model Goals The European social model is about social inclusion and equality of opportunity. Barrosso July 12, 2005

34. The European Social Model Goal The European social model is about social inclusion and equality of opportunity. Barrosso July 12, 2005 Strategy Middle class inclusion Universalism Human capital response to ageing societies Employment Equality of conditions