Financial Aid & Scholarships Senior Checklist

This checklist provides information on how to qualify for financial aid and scholarships, particularly in the state of Colorado. One of the options, for instance, is through the College Opportunity Fund (COF

- Uploaded on | 1 Views

-

phoebewang

phoebewang

About Financial Aid & Scholarships Senior Checklist

PowerPoint presentation about 'Financial Aid & Scholarships Senior Checklist'. This presentation describes the topic on This checklist provides information on how to qualify for financial aid and scholarships, particularly in the state of Colorado. One of the options, for instance, is through the College Opportunity Fund (COF. The key topics included in this slideshow are . Download this presentation absolutely free.

Presentation Transcript

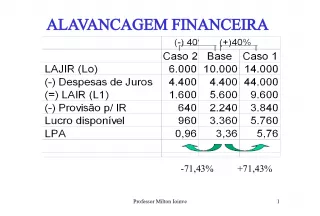

Slide1Financial Aid & ScholarshipsSenior Checklist

Slide2Authorize COF

Slide33College Opportunity Fund Pays a portion of total in-state tuition per credit hour • Colorado public institutions (2-year and 4-year) • Participating private institutions (Regis, DU and Colorado Christian University) $68 per credit hour in 09-10 school year ($1,632/year for a full time student) 145 credit hour maximum Must apply for stipend Must be admitted to participating institution Available for undergraduates only Paid directly to the school Apply online at: www.collegeincolorado.org

Slide44

Slide55

Slide77 Federal loans 41% Institutional grants 21% Pell Grants 14% Private and employer grants 7% State grants 7% Education tax credits and deductions 6% Federal grants not Pell Grants 3% Federal work-study 1% Total: $106.7-billion NOTE: Numbers are for undergraduates. SOURCE: College Board, "Trends in Student Aid 2008" http://chronicle.com/weekly/v55/i11/tuition_table.htm

Slide8FAFSA / Types ofFinancial Aid

Slide99

Slide1010Free Application for Federal Student Aid (FAFSA ) Available every January 1– apply early! • Some Financial Aid is awarded on a first come first serve basis • The earlier a student applies, the more financial aid they may receive • Must file every year • Will receive a Student Aid Report (SAR) via email and snail mail Name one type of financial aid.

Slide1111How to Submit the FAFSA Online application is fastest • Processed in 72 hours • Student and one parent need to get Personal Identification Numbers to sign application electronically • Parent and Student Information required: − Social security numbers, drivers license numbers − Records of money earned last year, tax returns and bank statements, etc. • Complete FAFSA online at http://www.fafsa.ed.gov • 1-800-4FEDAID paper applications BEWARE of any service that requires you to pay a fee to submit your FREE application

Slide1212

Slide1313

Slide1414 Grants • Awarded to the student based on need • Does not need to be paid back Scholarships • Does not need to be paid back • Check out our CollegeInvest Scholarship Program Work-study • Typically based on need Student Loans • Federal Loans − Paid back at federally backed low interest rates with helpful terms − There are federal loans for students (Stafford loans) and parents (PLUS loans) • Private Loans − Use federal first and be sure to research the rates and terms carefully if you need a private loan to fill the gap. Financial Aid – The Four Types

Slide1515PELL Grant Eligibility determined from FAFSA 2009-2010 maximum amount $4731 Pro-rated if student is less than full time Need based grant EFC must be under $4041 When is College Goal Sunday?

Slide1616Academic Competitiveness Grant Eligible for Pell Grant Four or two year degree program Full time student $750.00 first year of undergraduate study • Successfully completed a rigorous high school program (Higher Education Admission Requirements) $1,300.00 second year of study • Second year of undergraduate study have a cumulative grade point average of 3.0 No specific major required

Slide1717The SMART Grant (National Science & Mathematics Access to Retain Talent) Available during the third and fourth years of undergraduate study Eligible for Pell Grant Enrolled in a four-year degree granting institution Full time student Up to $4,000.00 per year A cumulative 3.0 grade point average

Slide1818The SMART Grant (National Science & Mathematics Access to Retain Talent) Must major in: • Physical life, environmental, nutrition, or computer science • Engineering • Mathematics • Technology • Critical Foreign Language • Food Science, Technology, and Processing • Fishing and Fisheries Science Management • Forest Sciences and Biology • Wood Science and Wood Products/Pulp and Paper Technology • Wildlife and Wildlands Science and Management • Biopsychology • Physiological, Pyschology/Psychbiology

Slide1919TEACH Grant Up to $4000 in grant money per year for teaching students Undergraduates can qualify for up to four years, graduates for up to two years Must score above the 75th percentile on a college admissions test OR maintain a cumulative GPA of at least 3.25 Must be a student who intend to teach full-time in high-need subject areas for at least four years at schools that serve students from low-income families If the student does not meet the teaching requirements, the grant must be paid back as an unsubsidized loan • Colorado State University-Pueblo • Metropolitan State College of Denver • University of Colorado Denver • University of Northern Colorado • Jones International University • Colorado Christian University • Regis University

Slide2020Work Study Part-time hours Campus & Community offices/agencies Minimum wage & higher Earnings paid directly to students Often based on financial need Maximum earnings limit

Slide2121Perkins Loans 5% interest rate 9 month grace period Repaid to School Attended Must Complete FAFSA Need Based Must sign Promissory Note with Institution Undergraduate annual limits $5,500, graduate annual amounts $8,000 Schools have small loan pool. May need to apply by school’s priority deadline to be considered

Slide2222Federal Stafford Loans Payment begins 6 months after graduating or decreasing enrollments to less than half time No credit check required

Slide2323Subsidized & Unsubsidized Subsidized Stafford: Must Demonstrate “need” Fixed interest rate of 6.8% as of July 1 st , 2008 (for undergraduates, 6.8% for graduate students) No interest accrual during in-school period Unsubsidized Stafford: Not based on need Fixed interest rate of 6.8% as of July 1 st , 2008 Interest accrues while in school

Slide2424Federal Stafford Loans Grade Level Base Amounts * Additional Unsubsidized Total Amount Freshman $3,500 $2,000 $5,500 Sophomore $4,500 $2,000 $6,500 Junior & Senior $5,500 $2,000 $7,500 Preparatory coursework for enrollment in an undergraduate program $2,625 0 $2,625 Preparatory coursework for enrollment in an graduate program $5,500 0 $5,500 Teacher Certification coursework $5,500 0 $5,500 Aggregates $23,000 $8,000 $31,000 Source: CollegeAssist, 2008

Slide25What AboutScholarships?

Slide2626What is a Scholarship? Financial Aid that is awarded to you based on your individual characteristics. Each Scholarship will have their own set of criteria, deadlines and application process It is up to you to find Scholarships and submit applications Scholarships do not have to be paid back

Slide2727Components of a Scholarship Application Scholarship Application An Essay Letter of Recommendation or Nomination Letter Resume Official Transcripts Any additional information the scholarship committee requests Remember that every scholarship has different requirements, components and deadlines !

Slide2828Before You Get Started… Create a professional email account Begin checking your email regularly Get to know your SS # Update your voicemail

Slide2929 Scholarship Portfolio Recent tax return(s) for you and your parents Your resume Academic transcripts Financial aid award notices Student Aid Report (Documentation of the FAFSA application) Your Personal Profile Copy of scholarship checklist Copy of all applications you have gathered Timeline for your scholarship search A great general scholarship essay Copies of your recommendation and/or nomination letters

Slide3030Create A Resume Important Information To Include On Your Resume Name, phone number, email address Employment history with dates and accomplishments Honors, awards, or recognitions you have received Volunteer, leadership, and extracurricular activities Specialized skills or abilities Interests and hobbies Talk to friends, mentors, employers and parents to also edit and make corrections on the resume

Slide3131

Slide3232

Slide3333If you are unsure as to what to include in your Resume this website will help you along the way All you need to do if fill in the information that applies to you.

Slide3434Aside from Personal Information you will also be asked to add any Work Experience, Honors, Awards or any other Activities that you are involved in…Simple as that!!

Slide3535Here it is!! Your Resume!! You can save the document as well as print copies

Slide3636Letter of Recommendation and/or Nomination Letter Letter of Recommendation: A letter written by someone who admires you and can testify to your scholarship worthiness. Nomination Form: A document completed by someone who has the power and authority to recommend you for a scholarship. This may or may not accompany letters of recommendation. Teachers Employers People whom you have volunteered for • Formal • Informal Member/leader in club/organization you are involved in Instructors for activities outside of school

Slide3737The Scholarship Search Inquire about scholarships through: • High School • College(s) student is interested in attending • Local businesses • Religious organizations • Places of employment • Internet − www.collegeincolorado.org − www.fastweb.com • CollegeInvest − www.collegeinvest.org − Get a free copy of our scholarship workbook

Slide3838Klingon Scholarship

Slide3939Wool Scholarship 2008 Senior Winners 2008 Junior Winners

Slide4040Drink Milk Scholarship

Slide4141Write About Your Dog!

Slide42422008 Duct Tape Scholarship Winners

Slide43432009 Duct Tape Scholarship Winners

Slide4444Other Scholarships American Association of Candy Technologists Scholarship http://www.aactcandy.org/aactscholarship.asp Patrick Kerr Skateboard Scholarship http://www.skateboardscholarship.org/ Vegetarian Resource Group Scholarship http://www.vrg.org/student/scholar.htm Ball State University's David Letterman Scholarship http://cms.bsu.edu/ Tall Clubs International Scholarship http://www.tall.org/

Slide4545The CollegeInvest Opportunity Scholarship Thirty-Eight (38) randomly drawn $1,000 scholarships will be awarded to Colorado students who : • Attend a Colorado two or four-year college, or vocational college, or university • Will be full time, undergraduate students in the 2008-09 school year • Complete the Free Application For Federal Student Aid and have an EFC of $15,000 or less (FAFSA does not have to be completed prior to registering) • NO GPA or Essay requirements • Apply online at www.collegeinvest.org

Slide4646The CollegeInvest Service Scholarship Twenty seven (27) randomly drawn $6,000 scholarships (award amount will be divided over a two-year period, $3,000 each year) will be awarded to Colorado students who • Attend a Colorado two or four-year college, or vocational college, or university • Will be full time, undergraduate students in the 2008-09 school year • Complete the Free Application For Federal Student Aid and have an EFC of $15,000 or less (FAFSA does not have to be completed prior to registering) • Commit to 40 hours each year, for two years, in a service- to-children volunteer program • NO GPA or Essay requirements • Apply online at www.collegeinvest.org Deadline: April 1st

Slide4747

Slide48Have Questions?Need Help?

Slide4949Frequently Asked Questions My parents are divorced. Whose information do I put on the FAFSA? I have a stepparent. Do I need to include his/her information? I am making less money in the current year than the last year. How can I reflect this? How can I be considered independent even if I have answered ‘no’ to all the required questions? My grandmother lives with us, can she be included in our household size? My parents do not have a social security number, can I file a FAFSA?

Slide50Time LineSenior Year

Slide5151Time Line - Senior Year Fall Fall Apply for colleges Apply for colleges Apply for scholarships Apply for scholarships Early spring Early spring Complete and submit the FAFSA online Complete and submit the FAFSA online The government processes the form and determines your EFC The government processes the form and determines your EFC Receive and review the Student Aid Report (SAR) Receive and review the Student Aid Report (SAR) The information goes to colleges The information goes to colleges Late spring Late spring The colleges create an “Award Letter” The colleges create an “Award Letter” Compare offers; make decisions Compare offers; make decisions *Must be accepted to a college to receive an award letter *Must be accepted to a college to receive an award letter

Slide5252Helpful Tools FAFSA 4Caster • http://www.fafsa4caster.ed.gov • See what your EFC might look like College In Colorado • http://www.collegeincolorado.org • “Pay” tab then “Available Tools” • Financial Aid Award Estimator • Slope Calculator CollegeInvest • http://www.collegeinvest.org • For information on student loans and college savings

Slide53Questions?