Financial Development and Economic Growth in Romania: An Econometric Analysis

This dissertation paper, supervised by Professor Moisa Altar and written by MSc student Mihai Tarau, analyzes the relationship between financial development and economic growth in Romania using various econometric techniques and data from January 1992 to September 2001. The paper explores the positive link between financial intermediation and economic growth, and the role of financial depth and monetization of the economy as exogenous variables for output growth.

- Uploaded on | 0 Views

-

marlinborer

marlinborer

About Financial Development and Economic Growth in Romania: An Econometric Analysis

PowerPoint presentation about 'Financial Development and Economic Growth in Romania: An Econometric Analysis'. This presentation describes the topic on This dissertation paper, supervised by Professor Moisa Altar and written by MSc student Mihai Tarau, analyzes the relationship between financial development and economic growth in Romania using various econometric techniques and data from January 1992 to September 2001. The paper explores the positive link between financial intermediation and economic growth, and the role of financial depth and monetization of the economy as exogenous variables for output growth.. The key topics included in this slideshow are Financial development, economic growth, Romania, econometric analysis, financial intermediation,. Download this presentation absolutely free.

Presentation Transcript

1. Academy of Economic Studies, Bucharest Doctoral School of Finance and Banking Financial Development and Economic Growth in Romania Dissertation Paper Supervisor : MSc Student: Professor Moisa Altar Mihai Tarau

2. CONTENTS CONTENTS 1. Introduction 2. Economic Growth-Financial Development Nexus . 3. Theoretical Model of Analysis 4. Data Used and Econometric Estimations . 5. Conclusions

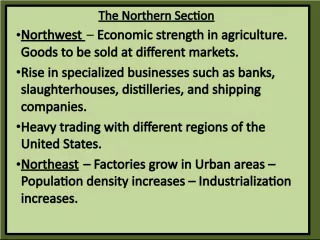

3. 1. Introduction Reasons wh y countries grow at different rates The pozitive link between financial intermediation and economic growth Financial depth and monetization of economy, as exogenous variables for output growth Simplified mathematical model: ARDL(1,1) & ECM Econometric estimations: OLS, UVAR & VECM (The case of Romania output growth from January 1992 to September 2001)

4. 2. Economic growth- financial development nexus Adams (1819) asserted that banks harm the morality, tranquility, and even wealth of nations Hamilton (1781) argued that banks were the happiest engines that ever were invented for spurring economic growth Robert Lucas (1988) dismisses finance as a major determinant of economic growth Merton Miller (1998): financial markets contribute to economic growth is a proposition almost too obvious for serious discussion.

5. Banks-Markets Distiction and rivalries Advantages and Disadvantages Its not banks or markets, it is banks and markets; these different components of the financial system ameliorate different information and transaction costs.

6. Five Key Components (Prerequisites) of a Performant Financial System: Sound public finances and public debt management Stable monetary arrangements Variety and influence of banks Credible Central Bank in stabilizing domestic finances and managing international financial relations Well-functioning securities market

7. 3. Theoretical Model of Analysis ARDL (1,1): (1) (2) (3) Long-run relationship (y stable) requires | b|<1.

8. (4) t is distributed independently from t ECM from ADL: (1-b) = speed of adjustment

9. The long-run (steady-state) relationship implied by the dynamic system in equations (1)-(4) is given by: (7) or (8) The main assumption is that there exist a single long-run relationship between the endogenous and forcing variables. The pre-requisites for consistent and efficient esti-mation are that the shocks in the dynamic specification be serially uncorrelated and that the forcing variables be strictly exogenous.

10. 4. Data used and econometric estimations The time series used are: qind = monthly value of industrial production in ROL; rtcrqind = (qind t /qind t-1 ) = industrial production monthly value rate of growth (chain), as a proxy for GDP monthly rate of growth; fd = monthly credit to non-governments in ROL; fdinq = (fd/q) = financial depth (credit to non-governments weight in monthly industrial production); rtcrfd = (fdinq t /fdinq t-1 ) = financial depth monthly rate of growth (chain); m2 = monthly value in ROL of monetary aggregate M2; m2inq = (m2/q) = monetary aggregate M2 weight in monthly industrial production; rtcrm2inq = (m2inq t /m2inq t-1 ) = monthly growth rate of M2 weight in industrial production (chain).

11. Figure 1 : Time Series Used

12. Granger Tests Conclusions: Industrial production is the endogenous variable in any relationship (at least under an one year lag) involving credit to non- governments and monetary aggregate M2, as it do not Granger cause any of the last two indicators. On the other hand, Granger tests reveal an extremely stable causality link between industrial production (as predicted variable) and credit to non-governments or monetary aggregate M2 (as predicting variables) in any lag of at most one year. Credit to non-governments is, in his turn, Granger caused by the monetary aggregate M2, all over one year period (thus having another time stable causality relationship). Financial depth rate of growth has a strong capacity of prediction over the industrial production rate of growth, for periods from one month to six months; the same relationship occur between monthly growth rate of M2 weight in industrial production and the industrial production rate of growth, but only for one quarter or one semester lags.

13. Selected Regression of rtcrqind

14. It can be also remarqed that the growth rates of financial depth and M2 weight in industrial production (which explain in the selected regression over 65% of growth rate from industrial production) proved themselfes earlier to be relevant regarding Granger causality tests. Regression Stability Test:

15. Figure 2 : Impulse Responses Functions of rtcrqind, rtcrfd and rtcrm2inq

16. Figure 3 : Variance Decomposition for rtcrqind, rtcrfd and rtcrm2inq

17. After proceeding a Johansen test for three I(1) integrated variables (qind, fdinq and m2inq), the cointegrated equation obtained support the initializing of a VEC model.

18. Figure 4 : Impulse Responses Functions of qind, fdinq and m2inq

19. Figure 5 : Variance Decomposition for qind, fdinq and m2inq

20. 5. Conclusions Long-run stability of the dynamic relationship between output growth and financial deepening (observed like weighted non- governmental credit and monetary aggregate M2 by the industrial production value) The limited effectiveness of the banking system is revealed by the extremely low level of banking sector credit in the economy, as banks are unable or unwilling to lend (the last possibility is best mirrored by the crowding-out effect that had a peak in 1999). Although the monetary aggregate M2 weight in industrial production seems to Granger cause the other variables and to be exogenous (indicating policy effectiveness), the responses of economic growth (and even financial depth) to shocks in its level are counterintuitive. The model may be augmented in case of finding better proxy variables for economic growth and financial intermediation, or we add other relevant variables omited (e.g. fiscal variables, bank supervision, asset prices a.s.o.).